When you pick up a prescription, you might not realize your pharmacy is giving you a specific version of a drug because your insurer preferred it. This isn’t random. It’s the result of a hidden system called a preferred generic drug list - a structured list of medications insurers push you toward because they’re cheaper, not because they’re better. And if you’re paying for prescriptions, this system affects your wallet more than you think.

How Insurers Decide What’s ‘Preferred’

Insurance companies don’t just randomly pick which generic drugs to cover. They use formularies - official lists of approved medications - to control costs. These lists are built by teams of doctors and pharmacists who review drugs based on safety, effectiveness, and price. The goal? Get you the same results for a fraction of the cost. The FDA says generic drugs are chemically identical to brand-name versions and must work the same way in your body. But here’s the kicker: generics cost 80-85% less on average. When six or more companies make the same generic drug, prices can drop by up to 95%. That’s not speculation - it’s documented by the FDA and confirmed by data from the Health Care Cost Institute. Insurers don’t just save money. They pass some of those savings to you. But only if you pick the right drug.The Tier System: What You’re Really Paying For

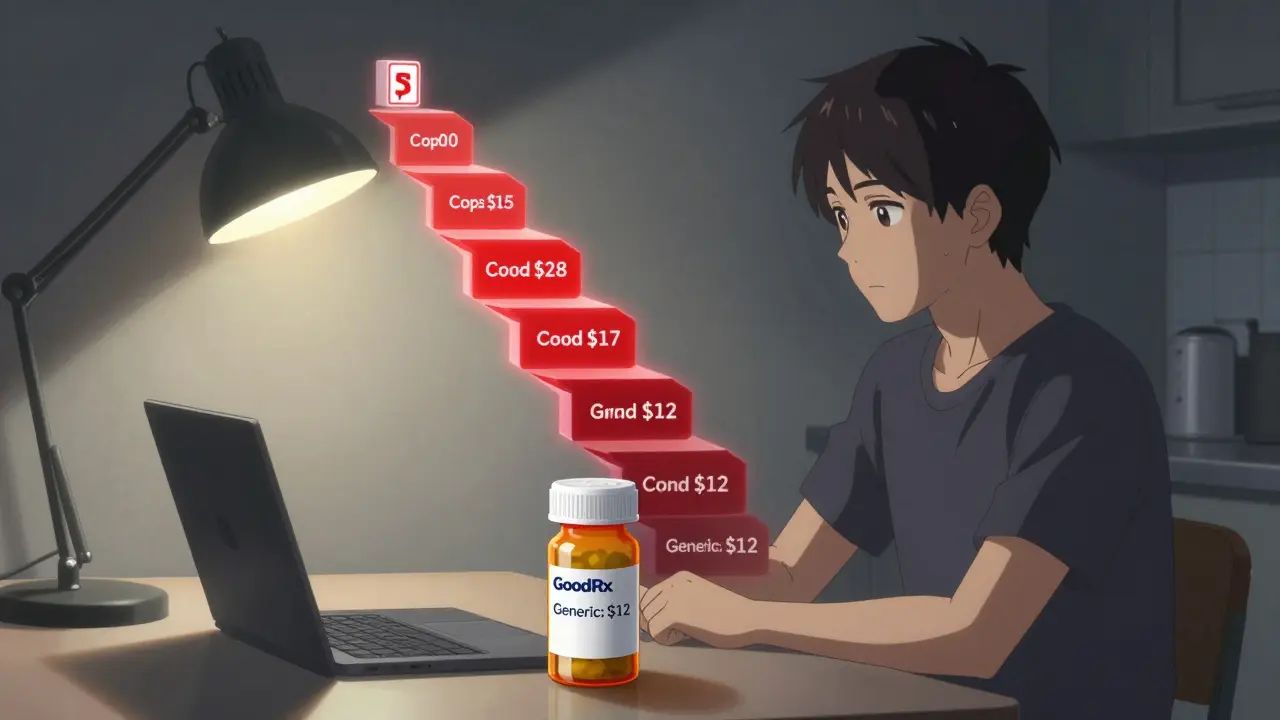

Most insurance plans use a tier system to organize drugs. Think of it like a pricing ladder:- Tier 1: Preferred generics - These are the cheapest. You’ll usually pay $5-$15 for a 30-day supply. Examples: lisinopril for blood pressure, atorvastatin for cholesterol.

- Tier 2: Preferred brands and some generics - A step up. Copays range from $25-$50. These are drugs insurers still encourage but aren’t the absolute cheapest.

- Tier 3: Non-preferred brands - These cost $50-$100. Your insurer wants you to avoid these unless necessary.

- Tier 4: Specialty drugs - Biologics, cancer meds, rare disease treatments. These can cost hundreds or even thousands. Coinsurance (a percentage of the price) often applies instead of a flat fee.

Why Generics Win - But Not Always

Generics dominate because they’re cheaper and just as effective. About 90% of all prescriptions filled in the U.S. are generics. But that doesn’t mean they’re perfect for everyone. Some drugs have a narrow therapeutic index - meaning tiny differences in dosage can cause big problems. Warfarin, a blood thinner, is one. A 2022 study by the American College of Clinical Pharmacy found that 23% of doctors avoid switching patients to generic warfarin because they worry about stability. That’s not fear of generics - it’s caution with a drug where precision matters. Then there’s the issue of biosimilars - cheaper versions of biologic drugs like Humira or Enbrel. These are newer, and insurers love them because they’re cheaper. But here’s the catch: brand-name biologics often come with co-pay assistance programs that cut your out-of-pocket cost to $0. Biosimilars? Usually none. So even if the list price is lower, you might end up paying more because you lose that help. One patient on Reddit reported paying $1,200 a month for Humira. When switched to the biosimilar Amjevita, the price dropped to $850 - but without the co-pay card, their actual cost didn’t change. That’s not a win for the patient. It’s a win for the insurer.

What Insurers Don’t Tell You

Insurers don’t just pick cheaper drugs. They also control access through rules you might not know about. Step therapy is one. It means you have to try and fail on a preferred generic before you can get the drug your doctor originally prescribed. The American Medical Association found that 42% of doctors report delays in treatment because of this - especially in chronic pain or autoimmune conditions. Prior authorization is another. Your doctor has to fill out paperwork just to get you a non-preferred drug. GoodRx’s 2023 survey showed 63% of patients hit this barrier at least once. And even when approved, it can take days or weeks. And then there’s the accumulator adjuster - a sneaky tactic some insurers use. If you’re on a biosimilar that has a co-pay card, the insurer might not count that savings toward your annual out-of-pocket maximum. So even if you’re paying less now, you’re closer to hitting your cap later. That means you could end up paying more for other meds down the line.How to Protect Yourself

You can’t change the system - but you can navigate it.- Check your formulary every year. During open enrollment, look up your medications on your plan’s formulary list. If your drug moved to a higher tier, you could pay hundreds more next year.

- Ask your pharmacist. In 89% of states, pharmacists can swap a brand-name drug for a generic unless your doctor says “dispense as written.” Most patients don’t know this. Ask.

- Use GoodRx or SingleCare. Sometimes the cash price is lower than your insurance copay. Compare before you pay.

- Appeal if denied. If your insurer refuses to cover your drug, 68% of appeals succeed - if you have a letter from your doctor explaining why the generic won’t work for you.

- Know your tier. If you’re on Tier 3 or 4, ask if there’s a preferred alternative. You might save $100+ per month.

The Bigger Picture

The U.S. spends $122.7 billion a year on generic drugs - 90% of all prescriptions - but only 23% of total drug spending. That’s because brand-name drugs, even when used rarely, are astronomically expensive. PBMs (pharmacy benefit managers) like CVS Health, OptumRx, and Evernorth control 78% of the market. They negotiate rebates, set tiers, and decide what’s “preferred.” New rules are coming. Starting in 2025, Medicare Part D plans must place biosimilars in the same tier as the brand-name versions. That could boost biosimilar use from 15% to 45%. But insurers are already pushing back with accumulator adjusters and other tricks. The future of formularies isn’t just about price. It’s moving toward value - meaning drugs that actually improve outcomes, not just cost less. UnitedHealthcare already tested this with 12 diabetes drugs in early 2024, adjusting tiers based on real-world patient results. But until then, the system is still built to save money - not necessarily to make your life easier.What Happens If You Ignore It?

Medicare’s 2023 survey found that 58% of enrollees didn’t know their plan’s formulary tiers. That’s why 31% got hit with surprise costs. You might think your drug is covered - until you get the bill. One user on Reddit said they were paying $187 a month for levothyroxine. Switched to the generic? $12. That’s $175 saved every month. $2,100 a year. That’s a vacation. A new pair of shoes. A month’s worth of groceries. But if they hadn’t checked their formulary? They’d have kept paying the brand price - because that’s what the pharmacy handed them. You don’t need to be a pharmacist to win this game. You just need to ask a few questions. Look at your statement. Call your insurer. Compare prices. Know your tier. Because in the end, this isn’t about drugs. It’s about who pays for them - and whether you’re paying more than you should.Why do insurers only cover certain generic drugs?

Insurers use preferred generic lists to reduce costs. These lists are built by medical experts who pick generics that are just as effective as brand-name drugs but cost 80-85% less. By steering patients toward these drugs, insurers save money - and often pass some savings to you in the form of lower copays.

Can I still get my brand-name drug if it’s not on the preferred list?

Yes, but it’s harder. You’ll likely pay more - sometimes a lot more. Your doctor can request an exception or appeal if the generic won’t work for you. In 68% of cases, these appeals succeed if the doctor provides documentation explaining why the preferred drug isn’t suitable.

Are generic drugs really as good as brand-name ones?

Yes, by law. The FDA requires generics to have the same active ingredient, strength, dosage form, and route of administration as the brand-name drug. They must also prove they work the same way in the body. Studies show 98.5% of approved generics are therapeutically equivalent. The only exceptions are drugs with very narrow therapeutic windows, like warfarin, where some doctors prefer to stick with one brand for stability.

What’s the difference between a generic and a biosimilar?

Generics are exact copies of small-molecule drugs (like pills for blood pressure or cholesterol). Biosimilars are similar, but not identical, copies of complex biologic drugs (like injectables for arthritis or cancer). They’re harder to replicate, so they’re not exact matches. Insurers prefer them because they’re cheaper, but they often lack co-pay assistance programs that brand-name biologics offer, which can make them more expensive for you.

How can I find out which tier my drug is on?

Log into your insurance plan’s website and search for your plan’s formulary. Most plans have a searchable drug list with tier information. Medicare Part D enrollees can use the Plan Finder tool. Commercial plans are less user-friendly - many score below 3 out of 5 in usability. If you can’t find it, call your insurer or ask your pharmacist.

Do pharmacies automatically switch me to a generic?

In 89% of U.S. states, pharmacists can substitute a generic for a brand-name drug unless your doctor writes “dispense as written” on the prescription. Most patients don’t know this - so if you want the brand, you need to ask. If you’re okay with the generic, you don’t need to say anything.

Why do some people pay more for a cheaper generic drug?

Sometimes, the brand-name drug comes with a manufacturer co-pay card that lowers your cost to $0. If you switch to a biosimilar or generic without that card, your out-of-pocket cost might not drop - or could even go up. Also, some insurers use “accumulator adjuster” programs that don’t count manufacturer discounts toward your out-of-pocket maximum, which can cost you more later.

Generic drugs are cheaper because they don’t need to pay for 10 years of marketing BS. Brand names charge $500 for a pill that costs $2 to make - and we’re supposed to be shocked? This isn’t healthcare, it’s corporate extortion.

I had no idea pharmacists could switch my meds without asking. I’ve been paying $180 for levothyroxine for years. Just found out the generic is $12. I feel like an idiot. Thanks for the heads-up.

My mom switched to generic and saved $200/month. She didn’t even notice a difference. Why do we make this so complicated?

Let’s not pretend this is about health. It’s about profit margins disguised as policy. The FDA says generics are equivalent - fine. But when your insurer forces you onto a drug because it’s cheaper, not because it’s better, you’re not being cared for - you’re being optimized. We’ve turned medicine into a spreadsheet. And now we’re surprised when people get sicker? The system isn’t broken - it’s working exactly as designed. To extract. To control. To silence dissent under the banner of ‘cost efficiency.’ We call it healthcare. It’s a marketplace with a stethoscope.

Wait - so you’re telling me the reason my insurance won’t cover my $1,200/month biologic is because ‘there’s a cheaper alternative’? But the cheaper alternative doesn’t come with a co-pay card? So I pay the same but lose my safety net? That’s not saving me - that’s just moving the pain to my credit score. This isn’t capitalism. This is psychological warfare wrapped in a formulary.

My dad had a stroke last year. He’s on warfarin. His doctor refused to switch him to generic because of the stability risks. I didn’t know that was even a thing. I thought generics were always fine. This whole system feels like a minefield.

If you’re still letting your pharmacy auto-switch your meds without checking, you’re literally giving money to insurance companies. Stop being passive. Your health isn’t a commodity. Go to your plan’s website right now. Search your meds. Call your pharmacist. Do it before your next refill. You’re not being lazy - you’re being exploited.

I used to think generics were just ‘okay’ - now I know they’re often better. I switched from brand-name statin to generic and my cholesterol dropped faster. No side effects. No drama. Just savings. Why do we still act like generics are second-class? They’re not. They’re the smart choice.

Formularies are the silent puppeteers of modern medicine - pulling strings behind sterile white walls, calculating rebates like poker chips, while patients sit in waiting rooms wondering why their pills cost more than their rent. The FDA says they’re equivalent - but who’s counting the emotional cost? The anxiety of switching? The fear that your body might ‘react differently’ to something that’s chemically identical? We’ve outsourced compassion to spreadsheets. And now we wonder why people don’t trust the system?

So let me get this straight - the system rewards me for taking the cheapest drug… unless the cheapest drug doesn’t come with a co-pay card that makes it free? Then I’m stuck paying the same as before? That’s not a feature. That’s a glitch in the Matrix.

My insurance changed my blood pressure med to a generic last year - I didn’t even notice. But my copay dropped from $45 to $8. I thought it was a mistake. Turns out I just needed to ask. Why isn’t this common knowledge?

For anyone reading this and thinking ‘I don’t have time’ - you have 45 minutes a year. That’s less than one Netflix episode. Spend it checking your formulary. You’ll save hundreds. Maybe even thousands. This isn’t rocket science. It’s basic self-advocacy. You deserve to know what you’re paying for.

My sister is on Humira. She pays $0 because of the co-pay card. They tried switching her to Amjevita - same price, no card. She cried. Not because of the drug - because the system doesn’t care if you’re drowning, as long as the numbers look good.

Accumulator adjusters are a form of financial obfuscation. They artificially inflate out-of-pocket obligations by excluding third-party subsidies from MEC calculations. This creates perverse incentives that undermine patient financial protection mechanisms.

India’s generic drug industry is the backbone of global access to medicine. We make these pills for pennies and ship them worldwide. Meanwhile, Americans get mad because their insurance won’t cover the $2 pill? Wake up. The problem isn’t the generic. It’s the middlemen. And the greed.