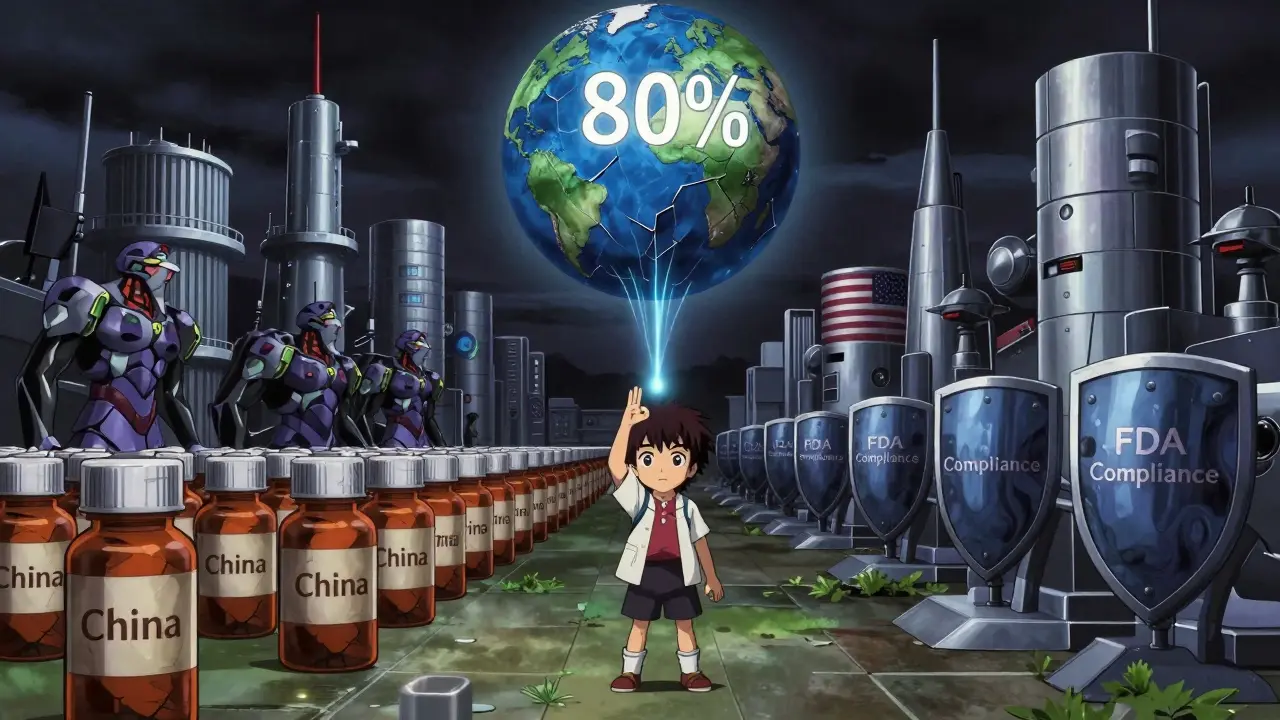

When you take a generic pill for high blood pressure, antibiotics, or diabetes, there’s a better than 7 in 10 chance that the active ingredient inside came from China. By 2023, Chinese manufacturers supplied 80% of the world’s active pharmaceutical ingredients (APIs)-the core chemical components that make drugs work. But behind this dominance lies a growing tension: extreme cost efficiency versus serious, documented quality risks.

How China Became the World’s API Factory

China didn’t become the top producer of generic drug ingredients by accident. After joining the World Trade Organization in 2001, the government poured billions into building chemical plants, offering tax breaks, relaxing environmental rules, and protecting local firms from foreign competition. By 2015, the country launched a major overhaul of its pharmaceutical industry with the goal of making its generics reliable enough to export. The result? Today, China produces more APIs by volume than the rest of the world combined.Companies like Sinopharm and Shijiazhuang Pharma Group run massive facilities that churn out 500 to 2,000 metric tons of APIs per year. These plants are built on a tightly controlled supply chain-60 to 70% of the production process, from raw materials to final intermediates, happens under one roof. That vertical control cuts costs dramatically. A kilogram of API made in China can cost $50 to $150, while the same ingredient from Europe or the U.S. might run $200 to $400.

But here’s the catch: China dominates the early, messy, and dangerous steps of chemical synthesis-fluorination, reactions with toxic solvents, and multi-step processes that require heavy handling of hazardous materials. Western and Indian manufacturers have largely walked away from these stages because they’re expensive and risky. China stepped in, not because it’s the safest option, but because it’s the cheapest.

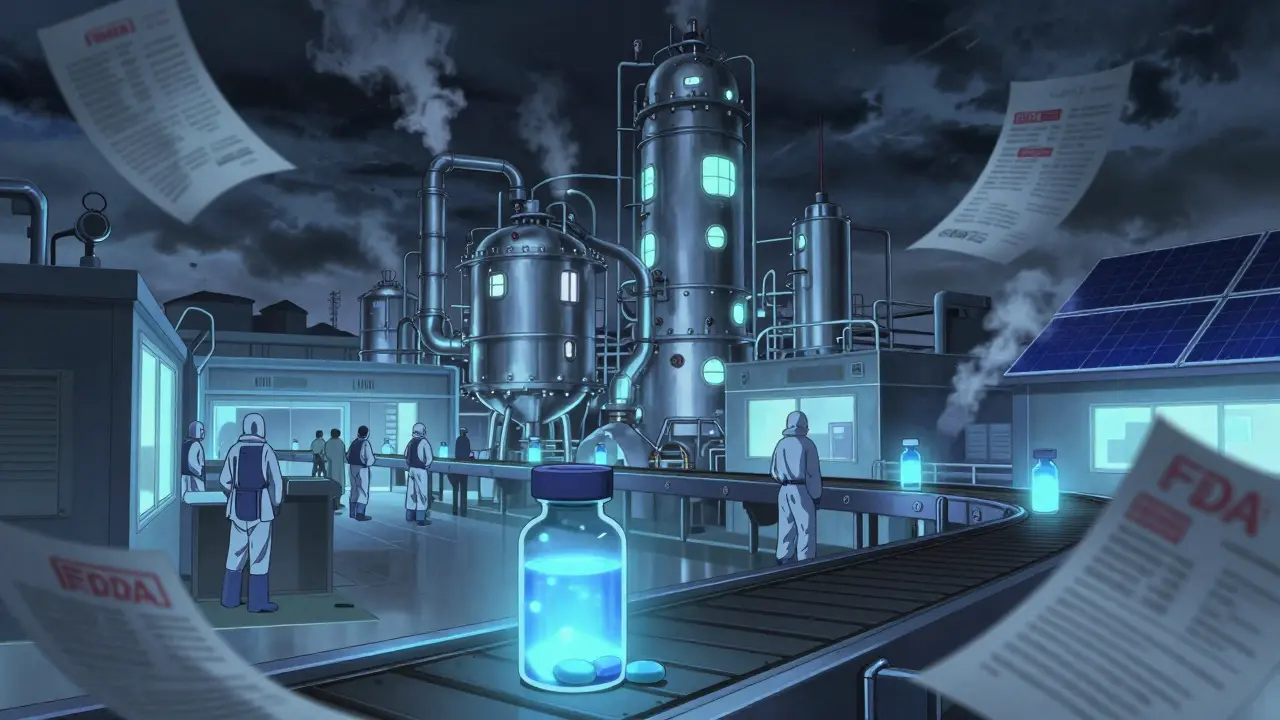

The Quality Gap: What the FDA Keeps Finding

Cost savings don’t always mean quality. The U.S. Food and Drug Administration (FDA) has been raising red flags for over a decade. Between 2022 and 2023, inspections of Chinese API facilities revealed that:- 78% had inadequate laboratory controls

- 65% failed to properly validate their manufacturing processes

- 52% showed evidence of data manipulation or record falsification

A 2023 FDA study found that 12.7% of Chinese API samples failed purity tests. Compare that to 2.3% from Europe and just 1.8% from U.S. facilities. These aren’t minor discrepancies-they’re failures that can lead to ineffective or even dangerous drugs.

Take the 2023 recall by Zydus Pharmaceuticals: over 1.2 million bottles of a blood pressure medication were pulled from shelves because the API from China’s Huahai Pharmaceutical was under-potent. Patients weren’t getting the full dose. That’s not a glitch-it’s a systemic issue.

Even more troubling? The FDA inspects Chinese plants at one-tenth the rate of U.S. facilities. Why? Access restrictions, visa delays, and political friction make it harder for inspectors to get in. As former FDA Commissioner Dr. Margaret Hamburg told Congress in 2024: “We’re flying blind on a huge chunk of the drug supply chain.”

China’s Own Reforms: Progress or Smoke and Mirrors?

The Chinese government knows the reputation problem. In 2016, it launched the Generic Consistency Evaluation (GCE) program, requiring all domestic generics to prove they work the same as the original branded drugs. So far, only 35% of approved generics have completed the process as of 2024. That means two out of three generic pills sold in China haven’t even been tested for real-world effectiveness.China has shut down 4,500 non-compliant manufacturers since 2018, cutting its generic drug factories from 7,000 to just 2,500. That sounds like progress. But many of the remaining plants still operate with outdated batch processing methods. In contrast, 35% of U.S. and European facilities now use continuous manufacturing-a more precise, automated, and quality-controlled method. China? Only 35% of its API production uses continuous methods. The rest? Old-school, labor-intensive, error-prone batch systems.

China’s National Medical Products Administration (NMPA) claims 95% of its GMP-certified plants now follow international standards. But the definition of “compliance” varies. A 2023 PwC survey found that Western companies entering China face 17 key differences in GMP rules-from how often they monitor air quality to how long they must keep lab records. What’s acceptable in Beijing might be a violation in FDA headquarters.

Who’s Buying? And Why?

Despite the risks, the world keeps buying. Why? Because no one else can match China’s scale and price. Indian companies, which make 20% of the world’s finished generic pills, get 65% of their APIs from China. The U.S. imports 88% of its APIs from overseas, and nearly a third of those come from China.For U.S. generic drugmakers, switching suppliers isn’t easy. A 2023 PhRMA survey found that 68% of manufacturers had experienced API quality issues with Chinese suppliers. But 42% of those same companies said the problems were worth it-because they saved millions. One company saved $4.2 million a year switching to Chinese amoxicillin API, even though 15% of shipments got rejected for quality.

Supply chain managers are caught in a bind. A 2024 Gartner survey gave Chinese suppliers a 3.2 out of 5 for quality consistency-far behind Europe’s 4.1. But they scored 4.7 out of 5 for price and 4.5 for production capacity. When you’re running a $500 million generic drug business, you pick the supplier who won’t run out of stock-even if you have to test every batch twice.

The Global Push to Diversify

The U.S. and EU aren’t sitting still. The 2022 CHIPS and Science Act included $500 million to rebuild domestic API production. The EU’s 2024 Pharmaceutical Strategy aims to cut China’s share of API imports from 80% to 40% by 2030. India is expanding its API capacity. Vietnam and Mexico are building new facilities with Western investment.China’s own “Pharma 2035” plan promises $22 billion in upgrades to modernize plants and improve quality. It wants to get 500 facilities FDA-inspected by 2027-up from 187 in 2023. It’s also requiring continuous manufacturing for 30% of high-volume drugs by 2026. That’s a real shift.

But here’s the reality: upgrading a single FDA-compliant API plant costs $85 million to $120 million. Annual maintenance? $3 to $5 million. For a company that’s been making cheap APIs for 20 years, that’s a massive investment. And many small plants simply can’t afford it.

What This Means for Patients

You might think, “If the drug works, why does it matter where it’s made?” But it does. A drug that’s 10% under-potent means your blood pressure stays high. A contaminated batch could trigger a rare allergic reaction. A drug that doesn’t dissolve properly won’t be absorbed. These aren’t theoretical risks-they’ve happened.Patients in the U.S., Europe, and beyond rely on Chinese-made APIs for life-saving medications: antibiotics, heart drugs, insulin, and cancer treatments. When a shipment fails inspection, recalls ripple across continents. When a plant shuts down due to non-compliance, shortages follow.

The truth? China is the backbone of the global generic drug system. But it’s a backbone with cracks. The system works because the world is willing to accept a higher risk of failure in exchange for lower prices. That’s not a sustainable model.

What’s Next?

McKinsey predicts China’s share of the global API market will drop from 78% in 2023 to 65% by 2030. That’s not because China is losing ground-it’s because others are catching up. But China won’t disappear. It’s too big, too cheap, and too integrated into the supply chain.For now, the answer isn’t to stop using Chinese APIs. It’s to demand better oversight, invest in independent testing, and build redundancy. Hospitals and pharmacies need to track where their APIs come from. Regulators need more resources to inspect. And patients need to know: the pill in your bottle might be safe. But it’s not guaranteed.

The next time you refill a prescription, ask yourself: Do I know where the medicine inside came from? And if I don’t, who’s checking?

So let me get this straight-we’re trusting our life-saving meds to a country that fakes lab data like it’s a TikTok trend? And we call this globalization? 😂

I get the cost savings, but imagine your grandma’s blood pressure med is 10% weak because of a batch from a plant that doesn’t even monitor air quality properly. We’re playing Russian roulette with people’s lives for $50/kg. This isn’t capitalism-it’s negligence dressed up as efficiency.

Statistical anomalies aside, the FDA’s 12.7% failure rate for Chinese APIs is statistically significant at p < 0.001. When compared to EU and US benchmarks (2.3% and 1.8%, respectively), the variance is not only non-random but structurally embedded in regulatory arbitrage. This is not a supply chain issue-it is a systemic failure of quality governance.

I’ve worked in pharma logistics for 15 years. I’ve seen the paperwork. I’ve seen the labels. I’ve seen the batches that got pulled. The system works because we’re all pretending it works. That’s the real tragedy.

You know, I think about this every time I refill my diabetes script-this little white pill, this thing that keeps me alive, could’ve been made in a factory where the workers are breathing in toxic fumes just to make it cheaper for me. And I’m not even mad, I’m just… sad. We’re all complicit in this quiet, slow-motion disaster, and nobody wants to talk about it because the alternative is paying $200 for a pill that should cost $10.

Test every batch. Track the source. Demand transparency. It’s not hard. It’s just inconvenient.

Let’s stop pretending this is about ‘cost’-it’s about power. The U.S. outsourced its manufacturing base for short-term profit, and now we’re begging China to play nice with our medicine supply. We created this monster. We’re not victims-we’re enablers. And if you think India or Vietnam can replace China overnight, you haven’t been paying attention. We need a decade-long national project to rebuild this, not just $500 million in CHIPS Act handouts.

My cousin works at a generic drug plant in Ohio. He says the real scandal isn’t China-it’s that American companies knew this was happening and still signed the checks. They didn’t have to. They chose to. And now they’re acting surprised when people get sick? Wake up.

China’s rise as the global API hub is not an accident of economics-it is the direct result of state-sponsored industrial espionage, intellectual property theft, and the deliberate erosion of international regulatory standards. This is not free trade. This is economic warfare. And until we treat it as such, we will continue to poison our own citizens with cheap, foreign-made poison.

As someone from Nigeria, I see this every day-our hospitals import generics from India, which import APIs from China. We have no testing labs. We have no oversight. We just pray. I don’t blame China. I blame the system that lets us be the last link in a chain of neglect.

India makes 20% of finished pills, but 65% of our APIs come from China. So we’re not independent-we’re just middlemen with bigger margins. The real question: why didn’t we invest in our own API production when we had the chance? We were too busy exporting software and call centers.

i wonder if the people who take these pills ever think about the hands that made them… the workers in shijiazhuang, breathing in chemicals, working 16 hours, paid $3 a day… and then we call them ‘cheap’ like it’s a compliment… maybe we’re not just buying medicine… we’re buying silence.

China’s pharmaceutical reforms are real, but slow. The GCE program is a step forward, even if incomplete. India and the West must stop vilifying China and start collaborating. We need joint inspections, shared standards, and technology transfer-not sanctions and fear-mongering. This is a global health issue, not a geopolitical battleground.

I just refill my script and don’t think about it. But now I’m gonna check the label. And if it says ‘Made in China’? I’ll ask my pharmacist if they test it. If they say no… I’ll switch brands. Even if it costs more.

Oh wow, so China makes our medicine? Shocking. Next you’ll tell me they make our iPhones and our solar panels too. Maybe we should stop being such suckers and just boycott the whole thing. Or maybe-just maybe-we should stop pretending we’re victims when we voted for the politicians who let this happen.