Not all generic drugs are created equal. While you might think a generic version of a brand-name pill is just a cheaper copy, that’s not true for complex generic drugs. These aren’t simple tablets with a single active ingredient. They’re liposomal injections, inhalers with precise dosing mechanisms, long-acting injectables, or peptide-based therapies. And getting them approved by the FDA? It’s a marathon, not a sprint.

What Makes a Generic Drug "Complex"?

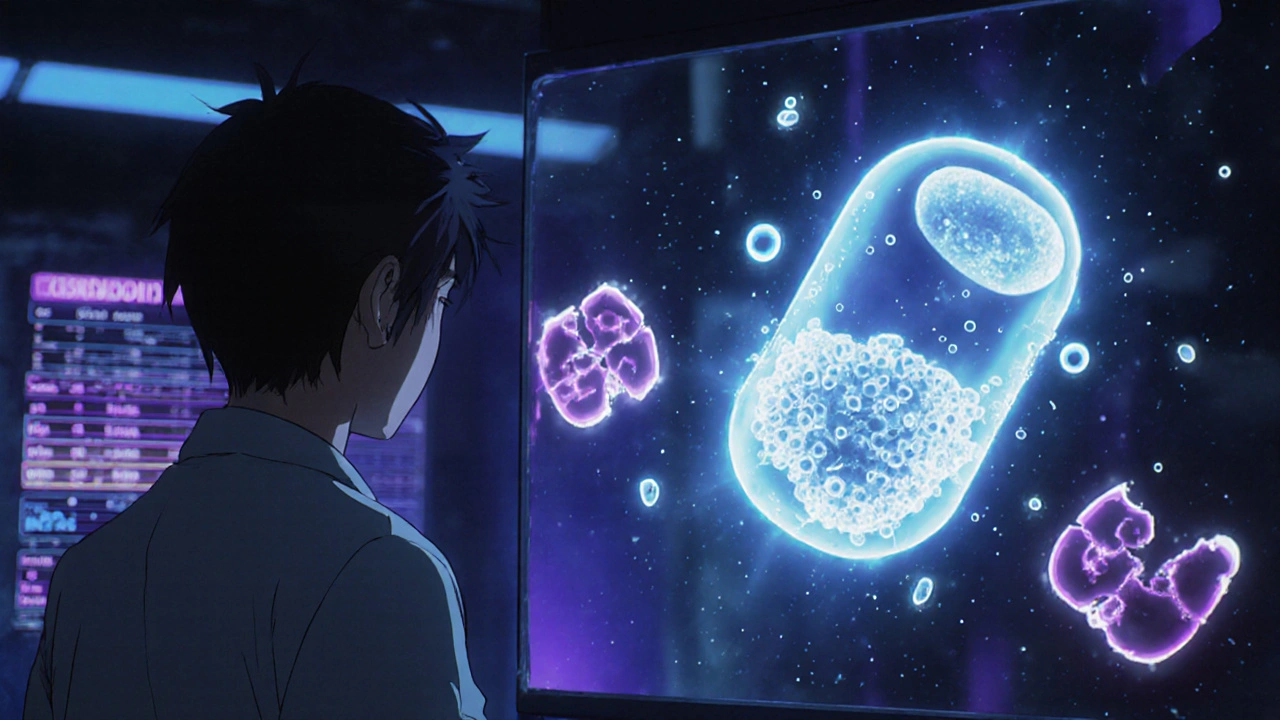

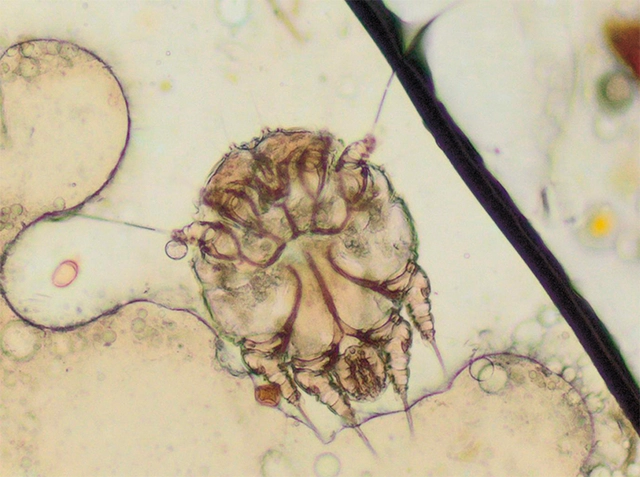

The FDA defines complex generic drugs by their physical and chemical makeup. It’s not just about the active ingredient-it’s how that ingredient is delivered. A standard generic aspirin tablet is easy to copy: same chemical, same dose, same release. But a liposomal bupivacaine injection? That’s a tiny fat bubble enclosing the drug, designed to release slowly over days. Copying that isn’t just about matching the drug-it’s about matching the bubble’s size, stability, and how it behaves in the body.

Other examples include:

- Long-acting injectables that last weeks or months

- Inhalers where the device shape affects how much drug reaches the lungs

- Polymer-based gels or patches that control drug release

- Pepides and biologics that are sensitive to temperature, pH, or even tiny impurities

These aren’t niche products. Many treat chronic pain, asthma, cancer, and autoimmune diseases. But because they’re so hard to replicate, very few generics ever make it to market.

The FDA’s Approval Roadblocks

The standard path for generic drugs is the Abbreviated New Drug Application, or ANDA. It’s called "abbreviated" because it doesn’t require new clinical trials-just proof that the generic behaves the same as the brand-name drug. That works for simple pills. But for complex drugs, "the same" isn’t obvious.

Take bioequivalence. For a tablet, you measure blood levels over a few hours. For a long-acting injection that releases drug over 30 days? You need to track levels for weeks. And even then, blood concentration doesn’t always tell you if the drug is working the same way in the body. That’s why the FDA had to develop entirely new methods for the first complex generic approval: bupivacaine liposome injectable in 2019. It took years of back-and-forth with the manufacturer to agree on how to prove it worked like the brand.

Then there’s the device. An inhaler isn’t just the powder inside-it’s the canister, the valve, the mouthpiece. If the generic inhaler’s nozzle is 0.1 millimeters wider, it might deliver less drug. The FDA requires the device to be identical. Even small differences that patients wouldn’t notice can block approval.

Why It Costs So Much and Takes So Long

A typical generic drug takes 2-3 years and $5-10 million to develop. A complex generic? It can take 5-7 years and cost $20-50 million. Why?

- Analytical challenges: You need advanced tools to measure the drug’s structure, particle size, and stability. Not every lab can do this.

- Formulation hurdles: Replicating a liposome or polymer matrix isn’t like mixing chemicals. It’s like reverse-engineering a recipe with no instructions.

- Regulatory uncertainty: The FDA doesn’t always have clear guidance. Companies spend months writing submissions, only to be told, "We need more data."

Since 2015, only about 15 complex generics have been approved by the FDA. Meanwhile, over 1,000 simple generics got through in the same period. The gap isn’t because no one wants to make them-it’s because the risk is too high.

The Role of Guidance and Pre-ANDA Meetings

The FDA tried to fix this with Product-Specific Guidances (PSGs). These are detailed documents telling manufacturers exactly what data they need to submit for each drug. As of 2023, there are over 1,700 PSGs, and more than 200 were updated in just two years. That’s progress.

But companies still struggle. Without a PSG, they’re flying blind. That’s why the Pre-ANDA Meeting Program became critical. Since 2017, the FDA has held over 1,200 of these meetings-where manufacturers sit down with FDA scientists before submitting anything. They ask: "What do you need? What will you reject?" It saves time. It saves money. But it’s not a guarantee.

One company spent four years and $40 million developing a generic inhaler. The FDA rejected it twice-not because it didn’t work, but because the device’s airflow pattern didn’t match the brand exactly. The manufacturer had to redesign the entire valve system. That’s the reality.

Global Differences Make It Harder

The U.S. isn’t alone. In China, the National Medical Products Administration (NMPA) often requires local clinical trials and a local agent. Brazil’s ANVISA demands certification of every lab and clinical site under international standards. Europe’s EMA has its own rules. A company that finally gets approval in the U.S. might have to start all over again overseas.

This fragmentation means complex generics are often only available in one or two markets-even if the patent has expired everywhere. Patients in other countries pay full price because no one dared to tackle the regulatory maze.

Who Benefits-and Who Gets Left Behind

Complex generics have the potential to cut drug costs dramatically. A single branded complex drug can cost $10,000-$50,000 per year. A generic version could drop that to $2,000-$5,000. But because so few get approved, patients often have no choice but to pay the high price.

Meanwhile, most FDA-approved generics today aren’t "first" generics. They’re the 4th, 5th, or 6th copy of an old, simple drug. These add little to competition because the market is already crowded. The real savings-on complex, high-cost drugs-are stuck in regulatory limbo.

Experts argue the FDA needs to prioritize drugs patients can’t access. Right now, there’s no system that tracks which high-cost drugs have no generics and which patients are suffering because of it. Patient input is almost nonexistent in the approval process.

What’s Changing-and What’s Not

The FDA has made real efforts. They hired 128 new reviewers. They promised to review complex generic applications within 10 months. They’re investing in AI tools to predict bioequivalence and quality-by-design models to reduce trial-and-error.

But progress is slow. Even with AI, it’s hard to simulate how a liposome behaves in a human body. Regulatory science hasn’t caught up with the chemistry. The tools exist-but the frameworks to use them consistently don’t.

By 2028, complex generics could make up 25% of the $250 billion global generic market. But if approval rates stay low, that potential will remain unrealized. The science is ready. The demand is there. The system? Still stuck.

Until the FDA, manufacturers, and regulators worldwide align on clear, science-based standards, complex generics will remain rare-despite being exactly what patients need most.

The FDA’s approach to complex generics is fundamentally outdated. We’re asking regulatory scientists to evaluate nanoscale drug delivery systems with tools designed for aspirin tablets. The analytical methods simply haven’t evolved with the science. It’s not that manufacturers are lazy-it’s that the framework doesn’t exist to validate these products efficiently. We need a new regulatory paradigm, not more paperwork.

And yet, we keep treating this like a compliance issue instead of a scientific one. Liposomes aren’t just ‘similar’ to the original-they’re dynamic systems that interact with biological membranes in ways we still don’t fully understand. How can we claim bioequivalence without real-time in vivo tracking? We’re flying blind with blood draws and HPLC.

AI could help, but only if we feed it real patient-level pharmacokinetic data, not just lab averages. The FDA has the data, but it’s locked behind bureaucratic walls. Open it up. Let researchers collaborate. Stop treating drug development like a courtroom drama where every comma is a crime.

Meanwhile, patients with chronic pain or cancer are stuck paying $40k/year for a drug that could cost $3k if we had the guts to modernize regulation. This isn’t just inefficiency-it’s institutional neglect dressed up as caution.

Oh wow, a 20-page essay on why rich drug companies can’t copy a pill. How tragic. Let me grab my tiny violin. The real problem? Americans think every drug should be cheap. Guess what? If it’s hard to make, it costs more. That’s capitalism, not conspiracy.

And don’t give me that ‘patients suffer’ nonsense. If you can’t afford $10k/year for a life-saving drug, maybe don’t live in a country where healthcare is a luxury. Go to India. Get the generic. Problem solved. Stop whining about innovation being hard.

I’ve worked in pharmacy for 18 years, and I’ve seen patients cry because they couldn’t afford their inhaler. I’ve also seen generics that didn’t work because the device was off by a fraction. This isn’t abstract-it’s people’s lives.

The FDA isn’t the villain here. They’re trying to do the right thing with bad tools. The real issue? We’ve trained a generation of scientists to think in terms of tablets, not nanoparticles. We need more funding for regulatory science, not just more reviewers.

And we need to stop pretending that ‘more data’ is always the answer. Sometimes, you need better questions. Like: What does ‘equivalent’ even mean when the drug’s behavior is shaped by its container, not just its chemistry?

Let’s stop blaming manufacturers. Let’s stop blaming regulators. Let’s fund the science that bridges the gap.

Wow. A 1500-word op-ed on why generics are hard to make. And yet, somehow, no one mentions that the brand-name companies are the ones lobbying to keep the rules vague. They fund the FDA’s ‘guidance’ process. They write the PSGs. They profit from the ambiguity.

This isn’t about science. It’s about rent-seeking. The FDA doesn’t lack tools-it lacks incentive. The same companies that made $50 billion on the brand version are now suing every generic applicant who dares to copy their ‘complex’ delivery system.

And you call this ‘regulatory rigor’? It’s corporate capture with a lab coat.

In India, we make simple generics like it’s second nature. But complex ones? We barely touch them. Why? Because the cost of compliance is higher than the profit. We have the scientists. We have the labs. But the FDA doesn’t trust us. The EMA doesn’t trust us. Even our own regulators are scared to approve anything that doesn’t look like a Western product.

It’s not about ability. It’s about perception. A liposome made in Hyderabad is assumed to be inferior-even if it’s identical. That’s the real barrier. Not science. Bias.

And yet, we’re the ones supplying 40% of the world’s generics. Imagine what we could do if we weren’t treated like second-class innovators.

so like… the fda is just being extra hard on generics bc they dont wanna mess up? like, why not just say ‘eh, close enough’ and let people use it? ppl are dying waiting for approval. its not like the brand name one is magic. its just expensive. why cant we just let the market decide?

The FDA’s 10-month review window is a farce. The average complex generic submission contains 12,000 pages of data. No human can read that in 10 months. This is performative efficiency.

Meanwhile, the manufacturers submit incomplete data on purpose, knowing they’ll get a ‘deficiency letter’ and restart the clock. It’s a game of regulatory chicken.

And the worst part? The same people who scream about drug prices are the ones who refuse to fund the FDA adequately. You can’t have cheap drugs and underfunded regulators. It’s math, not morality.

Let me be clear: if you can’t replicate a liposome, you don’t belong in pharma. This isn’t rocket science-it’s chemistry. If your lab can’t reverse-engineer a drug delivery system after 5 years and $40 million, you’re not a manufacturer. You’re a failure.

And the FDA? They’re just playing along to avoid liability. If a patient dies because a generic was ‘close enough,’ they’ll get sued. So they demand impossible data. It’s not science. It’s legal insurance.

Stop pretending this is about safety. It’s about avoiding blame. Patients pay the price for institutional cowardice.

One cannot help but reflect upon the epistemological foundations of bioequivalence in the context of nanoscale pharmaceuticals. The Cartesian reductionism that underpins modern pharmacokinetic modeling is fundamentally inadequate when applied to systems whose emergent properties are non-linear and context-dependent.

Is it possible that the very notion of ‘equivalence’ is a linguistic artifact of an industrial age? Perhaps we are not failing to approve complex generics-we are failing to conceptualize them.

The FDA’s reliance on blood concentration curves is akin to judging the quality of a symphony by measuring the volume of a single violin. The system is not broken. It is misaligned with reality.

You all are missing the point. The real issue isn’t the science. It’s not the FDA. It’s not even the money. It’s that we’ve turned healthcare into a market, not a right. If this were a vaccine for a pandemic, we’d throw billions at it and fast-track it in months.

But because it’s for chronic pain, asthma, or autoimmune disease-diseases that don’t make headlines-it’s left to rot in regulatory purgatory.

Patients aren’t numbers. They’re people who wake up in pain every day. And we’re arguing over liposome size while they suffer. That’s not regulation. That’s moral bankruptcy.